We provide Tax Services for Non Residents who own Property in Spain.

This covers fiscal representation, obtaining your NIE, presentation of tax assessments and arrange for direct debit for local taxes.

See our Welcome Pack

FISCAL REPRESENTATION

Although not necessarily required by law, it is highly advisable that any Non Resident owning a property in Spain appoints a fiscal representative.

This will be your contact person with the tax office and will remit and receive any tax notifications on your behalf.

By using our Services for Non Residents, you will have security. We will manage all the communications from the tax office addressed to yourself. This would normally be sent to your property.

If you are not living there permanently this may get lost, and you could be subject to fines for not replying to a tax request.

Also the fiscal representative will prepare and sign any tax assessments on your behalf.

NUMBER OF IDENTIFICATION OF FOREIGNERS (NIE Number)

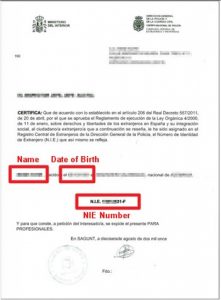

In Spain everybody is assigned a Tax Identification Number, which must appear on all tax returns and on all communications with the Tax Authorities.

All non residents have to apply for a Number of Identification of Foreigners ( NIE number ), as this number will be required to present any tax assessment.

Alternatively this can be applied for by our Tax Services for Non Residents on your behalf. With power of attorney, you will avoid losing any valuable time in long queues at the police Station.

NON RESIDENT INCOME TAX FOR THE USE OF YOUR OWN PROPERTY

Any Non Resident owning a property in Spain is liable annually for the Spanish Non Resident Income Tax (\”Impuesto sobre la Renta\”).

The tax authorities consider that even if the property is not rented out there is a presumed income from the use of the property by the owner since the purchase.

The income will be worked out on the rateable value of the property as shown in the local rate receipt, no expenses can be deducted.

If the property has been rented for a certain term during the year, this tax is worked out proportionally to the period the property has been used by the owner.

In the case of properties owned by more than one person , i.e. married couple or co-owners, each owner will have to present an individual tax assessment.

This income tax becomes due at the end of each year, on the 31st of December and has to be paid in the following year (1st of January -30th of December).

See our Welcome Pack

INCOME TAX ON RENTED PROPERTIES

If the property is rented out, income tax has to be paid on the rent received. The tax becomes due as soon as the rent is received.

In normal circumstances quarterly tax assessments can be presented in April, July, October and January of each year. Where all the amounts received for the rental of the property during the past quarter are declared.

In the case of property owners from the UE certain expenses can be deducted on the income received.

Our Tax Services for Non Residents will ensure your taxes are paid on time every time.

In this case income tax assessments for the use of the property have to be presented even if the rental does not cover all the year.

WEALTH TAX

This tax has been temporarily re-established for the years 2016 and 2017. This tax levies the mere ownership of property. The assessment has to be presented by any owner whose assets exceed the net value of 700.000 Euros.

If the property is owned by more than one person, i.e. married couple or co-owners, each owner will have to present an individual tax assessment and will have this tax exemption of 700.000 Euros.

Also the assessment has to be presented by any person whose assets exceed a gross value of 2.000.000 Euros.

Although no tax may be due taking into account the charges on the property.

The wealth tax becomes due at the end of each year, i.e. on the 31st of December and has to be paid between May and June of the following year.

CAPITAL GAINS TAX

If an owner sells their Spanish property, they have to present a capital gains tax assessment.

The capital gains is the difference between the net sales price (i.e. after deducting the expenses of the sale) and the purchase value (purchase price plus expenses).

This is updated according to a coefficient which depends on the date of the purchase, the difference (net gain ) tax has to be paid at the rate of 21%.

A tax assessment has to be presented even if there has been no capital gains.

When a Non Resident owner sells their property , the purchaser has to withhold 3 % of the purchase price to be paid to the tax office on account of the capital gains tax of the vendor.

After the sale the vendor has to present the capital gains tax assessment and effect payment of any balance tax due or apply for a refund if the resulting tax is less than the 3 % retained.

If no tax is due at all because there has been no gain the vendor will apply for the refund of the full amount retained. This is very common in the present economical circumstances.

The tax becomes due on the date of the sale of the property, the purchaser has a term of one month from the date of the sale to pay the 3 % retention.

The vendor in turn has to present the capital gains tax assessment within of 4 months from completion.

LOCAL TAXES

Any Non Resident owner of property will have to pay annually the local rates on the property known as Impuesto sobre Bienes Inmuebles.

The value for the property stated on this receipt is the rateable value on which the income tax is worked out.

This tax has to be paid to the Local Council, and the statutory period of payment varies depending on the location of the property.

We strongly advise that a direct debit is set up for the payment of the receipts in order to avoid possible surcharges and interest in case of late payment.